Clean hydrogen is a pillar of the U.S. strategy for reducing carbon emissions, and the UWUA is focused on ensuring that this growth includes high-quality jobs for members. Federal and several state governments as well as private industry are betting heavily on clean hydrogen production and deployment across a variety of hard-to-decarbonize sectors of the economy, and excitement is bubbling around its potential. Demand for clean hydrogen is projected to increase three- to five-fold over the next 10 to 15 years.

The vision is a “hydrogen economy” – one in which “clean” hydrogen (meaning that produced from emission free sources) will provide a significant percentage of the nation’s energy for electricity, transportation, industrial process, and other uses.

This transition will require far-reaching changes – political, technological and economic. Utilities are planning to be at the center of these developments and, in some cases, driving them, so understanding the opportunities and challenges is crucial, since the power generation and natural gas sectors of our industry will be impacted.

UWUA stays on top of hydrogen trends to understand how these changes will affect members and their jobs. Our priorities are to ensure no existing jobs are lost while positioning members for the jobs of the future.

The UWUA experience

A few UWUA locals are on the vanguard, engaging with employers to plan for the hydrogen economy. More need to be taking an active role. Take the advice of Local 483 President Ernie Shaw and be proactive: “You’ll be on the front line of wherever this hydrogen economy takes your company. You need a seat at the table.”

In Southern California, Locals 483 and 132 approached SoCal Gas about joint planning shortly after the California Public Utilities Commission issued best practices on renewable natural gas back in 2016 and the threat of shutting down the Aliso Canyon storage facility emerged. SoCal welcomed the union’s involvement. Shaw says Robin Downes was 483’s president at that time, and that Downes and Paul Carriera, 483 then vice president, were instrumental in mapping out a future for SoCal’s gas workers.

When Downes retired in 2020, Shaw was able to quickly pick up the baton and keep the plan moving forward. “483 members are SoCal’s transmission workforce, so we see this as a partnership. Without the company, we have no jobs, and no union. We both have a vested interest in making sure hydrogen succeeds.”

Local G-555 in Ohio had a similarly positive reception when it approached Dominion Energy about a year ago to propose a partnership to ensure that both the company — and its union workforce — are preparing for the future. Eddie Hall, the local’s president, took the initiative with the help of James Harrison, the UWUA’s renewable energies director. Hall said, “The company was surprised but very receptive to the idea of working with the union on this, and they have since included us every step of the way.”

According to Hall, Dominion is committed to a transition to hydrogen. “It’s not hype. It’s real. Europe is already way ahead of us, so we can see it happening.”

What is hydrogen?

Hydrogen is the most plentiful element in the universe and packs a lot of power. On a weight basis, it contains nearly three times the energy of gasoline. It’s easy to store and burns relatively cleanly. When combined with oxygen in a fuel cell battery, hydrogen produces heat and electricity with only water as a by-product.

Hydrogen is the most plentiful element in the universe and packs a lot of power. On a weight basis, it contains nearly three times the energy of gasoline. It’s easy to store and burns relatively cleanly. When combined with oxygen in a fuel cell battery, hydrogen produces heat and electricity with only water as a by-product.

But hydrogen does not exist in its pure form on earth. It occurs in compounds such as water, natural gas and other organic hydro-carbon materials. Separating hydrogen from the other elements in these compounds requires energy to break the molecules apart.

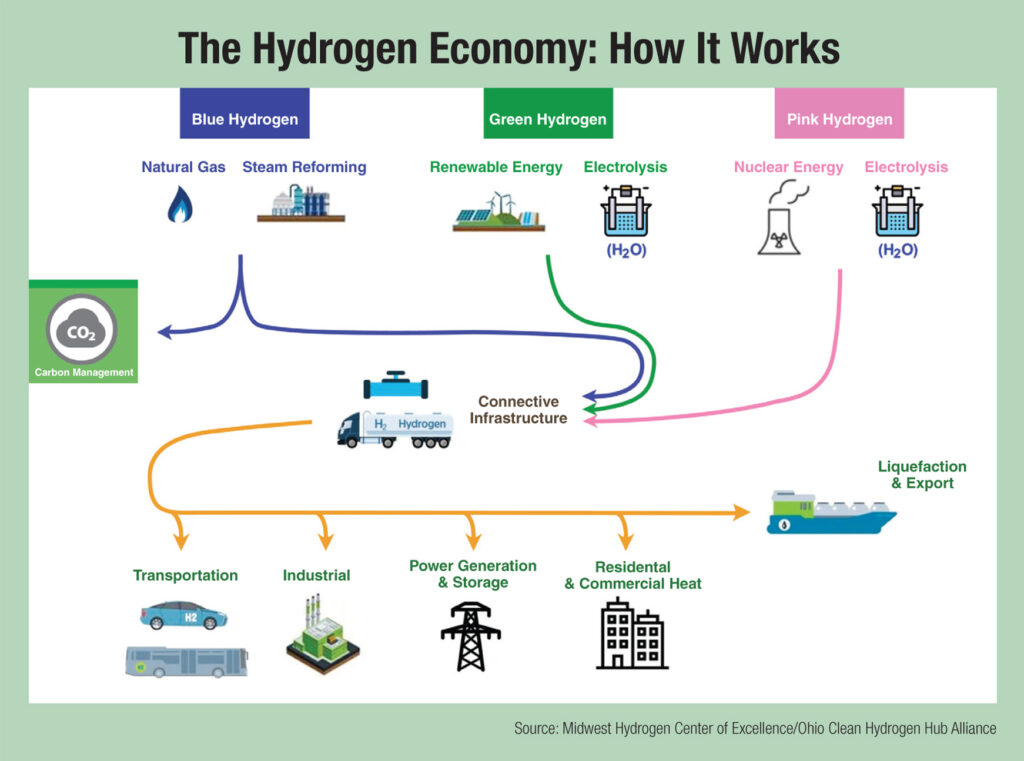

Hydrogen is a colorless gas but goes by colorful names, depending on the production feedstock and the environmental impact of the extraction process. Today, about 98% of U.S. hydrogen comes from fossil fuel feedstock and processes that do not employ carbon dioxide (CO2) emissions controls. Natural gas accounts for 95% and produces what’s known as “gray” hydrogen; the 4% derived from coal is known as “brown” or “black” hydrogen. The steam process powered by natural gas releases 9.3 times as much CO2 emissions into the atmosphere as using hydrogen saves.

So, the focus has been on trapping these emissions through carbon capture systems (CCS) to produce what’s called “blue” hydrogen or developing renewable energy sources of hydrogen extraction to make “green” hydrogen. The electrolysis of water, which uses electricity to split water into hydrogen and oxygen is the most environmentally friendly and has the potential to be the dominant method of production — but only if it can become cost competitive.

In the meantime, blue hydrogen produced from natural gas with CCS and “pink” hydrogen from nuclear power plants are being looked at as bridge production methods.

U.S. climate policy and energy strategy

Scientists have explored hydrogen as a fuel source since the early 19th century, but it has gained attention as concerns about the impact of CO2 emissions have escalated, especially after the Paris climate agreement in 2015.

In 2021, the Biden administration pledged to cut U.S. greenhouse gas emissions in half from 2005 levels by 2030. The plan calls for the power sector to eliminate carbon emissions by 2035 and move to a carbon net-zero economy no later than 2050 – “all while creating good-paying, union jobs at home,” the White House says.

Against this backdrop, the quest for alternative energy sources gains urgency. Solar and wind power are now cost competitive on a dispatch basis but storing that intermittent electricity at scale remains challenging and costly. Moreover, some applications like transportation and heavy industry — think long-distance trucking and steel mills — are not well suited to electrification. This has spurred the drive for a fuel source that is easy to make, store, transport and use without CO2 emissions.

Governments and companies worldwide are looking to blue and green hydrogen as the answer. Excitement has focused on hydrogen’s potential in three areas:

- To store excess renewable energy when the electric grid cannot accommodate and save it for later use

- To decarbonize sectors that are hard to power with electricity

- To replace fossil fuels as a feedstock in chemicals and fuel production and transportation

By 2035, McKinsey & Co. forecasts that 60% of hydrogen in use will be emission free. The Big Three and other automakers including Toyota and Mercedes Benz are committing to heavy duty fuel cells, particularly for trucks, and gas turbine and pipeline manufacturers are making equipment that can transition from natural gas to blue and then green hydrogen once supply chains ramp up.

However, widespread adoption of hydrogen hinges on making emission free sources cost competitive. According to private energy data provider BloombergNEF, green hydrogen currently costs up to $9.62 per kilogram compared to $2.72 for blue. The United States aims to reduce the cost of emission free hydrogen to $1 per kilogram by 2030.

Federal dollars for hydrogen

Between the recently enacted Inflation Reduction Act (IRA) and last year’s Bipartisan Infrastructure Bill (BIL), the federal government is investing tens of billions of dollars to reduce carbon emissions, with specific funding aimed at the development and promotion of emissions free hydrogen.

The BIL included funding for three “Energy Earthshots” — far-reaching initiatives by the Department of Energy (DOE) to jump-start the country’s clean energy economy:

- Clean hydrogen

- Long duration energy storage

- Carbon negative technologies

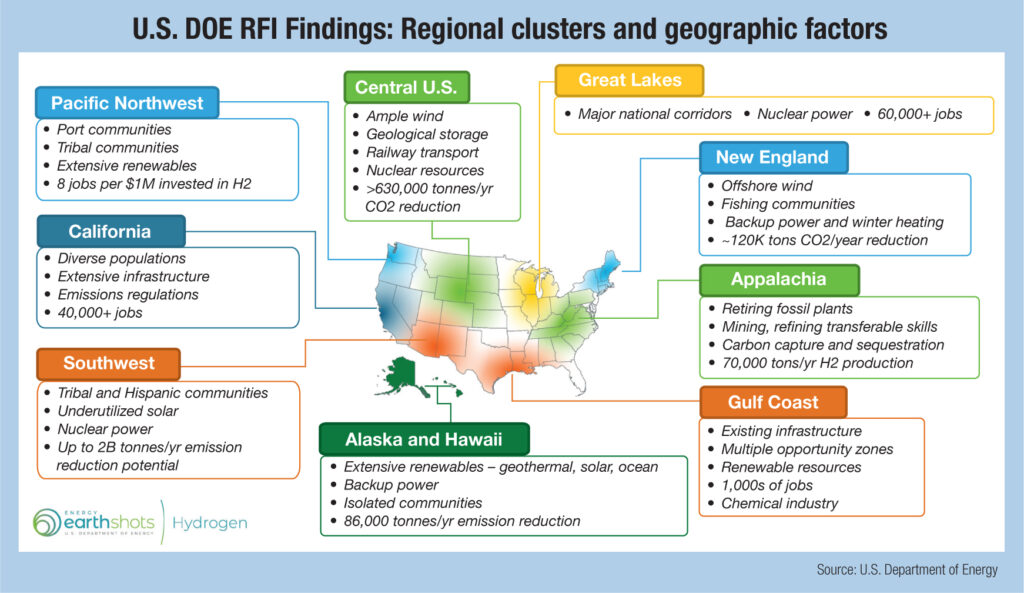

Earlier this summer, DOE started planning for total investment of $8 billion in regional clean “hydrogen hubs” to “accelerate innovation to spur demand of clean hydrogen by reducing costs by 80%” — and thereby encourage broad industrial, energy, and transportation uses. The concept of a hydrogen hub is described as a “network of clean hydrogen producers, potential clean hydrogen consumers and connective infrastructure located in close proximity.”

Tax credits built into the IRA for both blue and green hydrogen and CCS go even further. The IRA aims to lower green hydrogen costs to rates competitive with the predominant feedstock of natural gas and accelerate the timetable for bringing green hydrogen to the market at scale. In doing so it anticipates that energy-intensive industrial and heavy transport sectors will rapidly transition to green hydrogen use as it becomes the quickest and most predictable way to save on energy costs and benefit from tax premiums.

Even before the recent federal funding, the United States was seeing hundreds of millions of dollars a year in public and private investment pour into hydrogen, according to the Fuel Cell and Hydrogen Energy Association.

While states like California and Washington have been active on climate impacts for years, other states are following the federal government’s lead and adopting parallel policies such as Illinois’ 2021 Climate and Equitable Jobs Act. It calls for the state to use 100% renewable energy by 2050 and provides almost $700 million in subsidies for clean energy. With the state’s six nuclear facilities, it is well positioned to use inexpensive nuclear energy to power the production of hydrogen from electrolysis.

The race for hydrogen hubs

The BIL calls for the Department of Energy to award funding in two phases for at least four hydrogen hubs, with the first phase planned to begin in May 2023. Hub applicants need to show that hydrogen production, processing, delivery, storage and end-use are regional in nature. The UWUA provided comments to the DOE when it issued a Request for Information seeking comments from stakeholders on how it should structure its hub selection process, and our union’s input is reflected in the criteria that the DOE released for evaluating applications:

- Feedstock diversity – at least one hub shall demonstrate the production of clean hydrogen from fossil fuels, one hub from renewable energy, and one hub from nuclear energy.

- End-use diversity – at least one hub shall demonstrate the end-use of clean hydrogen in the electric power generation sector, one in the industrial sector, one in the residential and commercial heating sector, and one in the transportation sector.

- Hubs in natural gas-producing regions – at least two regional clean hydrogen hubs shall be located in the regions of the U.S. with the greatest natural gas resources

- Geographic diversity – each regional clean hydrogen hub shall be located in a different region of the U.S. and shall use energy resources that are abundant in that region.

The race is now on, and many states are competing for federal dollars to develop hub sites. Public-private coalitions are also working to fund and develop hydrogen hubs, including alliances in California, Texas, and the Tri-State region of Ohio/West Virginia/Pennsylvania. Utility companies are actively involved in many projects.

UWUA Local G-555 and Dominion Energy are part of the Ohio Clean Hydrogen Hub Alliance, which aims to establish a blue hydrogen hub. In areas of the country historically rich in coal and natural gas, blue hydrogen combined with CCS technologies offers a promising option, especially since many of these regions have extensive pipeline networks.

Blue hydrogen production is an important step in decarbonizing existing end-users such as power generation, transportation, industrial processes, and commercial applications. This blue hydrogen pathway can then support the policy and regulatory infrastructure necessary for green hydrogen once it becomes more affordable.

In Southern California, Locals 132 and 483 are working with SoCalGas and the Los Angeles County Business Federation to build a green hydrogen hub called the Angeles Link.

The Angeles Link would leverage California’s considerable on-shore wind and solar and potential off-shore wind resources to power the production of green hydrogen. SoCal estimates that the Angeles Link could produce enough green hydrogen to replace 25% of its current gas delivery. It would replace up to 3 million gallons of diesel fuel daily with hydrogen fuel cells and convert four natural gas generating stations to burn hydrogen. Combined with other clean fuel energy projects, SoCal Gas says that this project could significantly reduce its dependency on the Aliso Canyon underground natural gas storage facility.

A major renewable hydrogen hub is already under development in Delta, Utah, as part of an effort to decarbonize the western grid. The project plans to produce 100 metric tons daily of hydrogen through renewable-energy electrolysis of water starting in 2025. Salt caverns at the site will store the hydrogen, initially with enough capacity to power 150,000 households for a year. The Intermountain Power Agency’s power plant at the same site, currently one of the biggest coal-fired power plants in the United States and a major electricity supplier to California, will convert in 2025 to run on a blend of natural gas and 30% green hydrogen generated there. Plans call for it to shift to 100% green hydrogen in 2045.

Natural gas-hydrogen blending

Since 2020, U.S. natural gas utilities have launched more than 26 hydrogen pilot projects, many focused on blending hydrogen with natural gas. Because existing gas pipelines can transport blends with smaller shares of hydrogen, some of these projects have no extra costs for transmission infrastructure. As greater shares of hydrogen are added to natural gas blends, pipelines must be modified, or replaced, to prevent leaks of hydrogen’s smaller molecular size.

Hawaii is currently using a 12% hydrogen blend in its natural gas pipeline infrastructure to reduce methane emissions during distribution and end use, while in the Midwest, Wisconsin Energy Corporation and the Electric Power Research Institute are piloting a 25% hydrogen/75% natural gas blend to power two natural gas generation plants. BloombergNEF reports that half of the blend projects announced in the United States are expected to run on 100% hydrogen by 2045.

Shaping the hydrogen jobs of the future

Blue and green hydrogen remain important mileposts on the U.S. path to decarbonization. But it isn’t clear how technical developments, policy and funding will unfold.

Not in doubt are the dollars currently being poured into hydrogen’s development and the important roles utilities and their workers will play in shaping the outcomes. McKinsey & Co estimates that the hydrogen economy could support 700,000 jobs by 2030.

Local 483’s Shaw is optimistic that the hydrogen economy will mean more — and higher paying — jobs for 483’s members because hydrogen has greater demands than natural gas for both compression and storage. Compression stations for hydrogen would need to be located more closely together than those of natural gas, and hydrogen pipelines could also end up requiring more frequent inspections. These factors could mean more members, some at higher skill and pay levels, to operate and maintain compression and storage.

A study released by the California Public Utilities Commission in July found that blends above 5% hydrogen without pipeline modifications had increased risks of pipeline leaks and deterioration of steel pipes, and that mixes with more than 20% hydrogen raised the risk of ignition outside pipelines. Shaw isn’t turned off by these cautions; he sees them as potential work for his members in modifying or replacing pipeline originally built to carry natural gas.

Halfway across the country in Ohio, Eddie Hall at G-555 is optimistic, as well. “From what I see thus far, incorporating hydrogen into our mix will mean having to add additional workers. My members are very excited about the possibilities because they see the work as requiring a higher skill set, which they are prepared to learn, and better wages.”

However, high road labor standards that support existing union workers and provide opportunities for union job growth are not a forgone conclusion. Whether or not existing utilities are going to be allowed to transition over to hydrogen transport is not a foregone conclusion either. That’s why the UWUA is advocating for hydrogen to be regulated in ways similar to that of the delivery and consumption of national gas. The union is also partnering with the AFL-CIO, other energy unions, and labor and community-based groups to ensure that the transition to hydrogen includes high labor standards, supports union workers, and that labor has a seat at the table in both regional hub development and governance.

The development of hydrogen hubs and the expansion of a clean hydrogen economy promise to be significant opportunities to keep UWUA members employed in natural gas and power production utilizing the skill sets already possessed, put other energy workers back to work who have faced unemployment and hardships due to the energy transition that has already occurred, and make progress toward our planet’s climate goals. “There’s no question in my mind that UWUA members have the skills to take this on and make it work,” said Hall.

The rest of this decade will be critical in determining the future of the hydrogen economy and the jobs it will support. Your union stands ready to help your local take advantage of the opportunities ahead. Contact your UWUA regional representative; UWUA Director of Renewable Energies James Harrison (jharrison@uwua.net); or UWUA Legislative Director Lee Anderson (landerson@uwua.net) for more information on how to have these critical conversations with your employer and legislators.